Content

Precisely what do You should do For the reason that Expense? Virginian Payment Loan And personal Account Access Support Consolidation Assets Within the San Antonio Florida

Your very own 2019 NPRM widely recognized your method for try to avoid destruction is definitely a vital component your reasonable avoidability old-fashioned. Their 2019 NPRM announced that the problem associated with the 2017 Definitive Code is actually depicted through the how the Bureau clarified numerous reviews which will motivated your very own Bureau to mandate customer disclosures rather than towering a productivity-to-payback specifications. The 2019 NPRM told me which will undoubtedly FTC Function precedent informs your own Bureau’s understanding of your own unfairness standard underneath segment 1031 for the Dodd-Honest Act. This sort of additional circumstances try discussed in more detail partly V.C.step two right here. Component V.A posts certain of your own factual predicates so you can legitimate findings main this option using authority. Role V.B sets forth the Bureau’s authorized so you can informative basics, below piece 1031 regarding the Dodd-Honest Operate, for the withdrawing its finally finding that an injury regarding the motivated adventure is not really fairly preventable.

- Your own CFPB aims to counter or rewrite last guidelines present commercial collection agency.

- Just Alberta so to Manitoba got laws and regulations ready for its thriving-price tag card, while B.C.

- Their ASA provides over the past decided that using a reward adverts, aimed towards youngsters, you can easily triumph optimal term’s rent as an incentive to remove an account is definitely irresponsible .

Paycheck lenders will endeavour to assemble of consumer’s obligations primary by simply requesting for repayment. Once internal databases splits, its individual pay day creditors you may subcontract your debt databases, because market the debt up to a alternative party. In the Usa statutes, a paycheck lender could use merely the the exact same the market industry standard databases actions familiar with see various other debts, especially advice clarified under the Affordable Business collection agencies Conduct Act . Your own FDCPA prohibits collectors by using abusive, unfair, and also fraudulent behaviour to gather off from customers. These types of behavior are actually calling in the past ten o’clock in the morning and various eventually 7 o’clock at time, because calling customers at the job. Baddour said your own pay day loans marketplace is created to make the most of finding the buyers in financial trouble.

What Do You Want To Do With Money?

The theory is that, a paycheck lender shouldn’t have any query number of a credit score rating, as it will take money right out for this checking account. The problem is, if that member profile is actually clear, the lending company becomes nothing – and you also have got socked having big bank cost. It provides searching see how much money, generally breaking up their compensation inside lower amounts that are prone to continue with the. Also to, at the same time, the lender opens pestering one since calls so to send off from solicitors. Once nothing in this features, the financial institution is probably going to sell you borrowed from to the choices agency for that cents with the cash. This package bureau, plus in phoning as well as to text, access sue one on the credit.

For the room regarding the twenty four hours, a short-brand debt about beat associated check over here with the $5000 could be let it is easy to buyers with no cover your very own credit history. Same-week loans on google are particularly one of the quickest-developing financing means. Yet, it is still an enormous capital threat towards lenders as well as applicants equal. Loan providers maintain the more expensive menace because they matter these financing options with no card screening so you can disburse your own credit score rating during the swiftest route potential.

Virginian Installment Loans And Personal Loans

But in reality imposing underwriting standards is a bit more confusing than imposing different program security information. The words on Expenses Crashers is good for informative and academic objectives only and cannot continually be viewed become grasp funding tips. If you’d like this sort of standards, talk a licensed credit alongside tax advisor. Recommendations you can easily plans, will offer, so to terms off from 3rd party channels usually alter. Even as we does all of our advisable to stay this type of up-to-date, numbers mentioned on this website will change far from real prices.

Meanwhile, in the lead-possibly their presidential selection this year, features systems had gotten devoted less and less focus on poverty and difference for horse-race election coverage. Nearly 1 / 2 of every one of Us citizens—a comprehensive 46%—claim they would not be liberated to come up with $four hundred just in case of a crisis. Any outcome conditions of the dated signal are one tedious “ability-to-repay” obligations great “payments” bounds that may placed unrealistic limitations wearing a loan company’s ability to come compensation from a buyer.

Borrowers could probably incorporate payday advances to keep different-costly latter charges charged through the resources alongside children creditors, along with his use of payday advance loans can possibly prevent overdraft price which will undoubtedly or maybe you were energized the borrower’s checking account. Governmental appointees from the agency, dominated from its ceo, Kathleen Kraninger, acquired pushed pass with the Trump maintenance’s deregulatory immediate in spite of the logistical limitations posed through the coronavirus pandemic. Recently, your agency is anticipated to discharge their changed pay check rule, which should don’t brings financial institutions to assess regardless of whether buyers are able their charges over the years offering a credit score rating. A copy of memo was have by New york Period far from a freshly released agency employees.

Getting Your Loan Easy As One, Two, Three

Getting a financing select a journey whether your credit score is within the decreased assortment countries its individual substantial insufficient capital wisdom, and many loan providers comes into play adamant in terms of granting a person a loans. Various online charge loaning systems are adept in the supplying buyers owing expected financing in fastest night likely. As soon as you grow your question, you’re going to be qualified within a few minutes so to sanctioned for all the credit score rating reception if you should be finished with your web layouts. As a whole, the financial institution you may merely withdraw a point of money needed through the profile being later on because account expires.

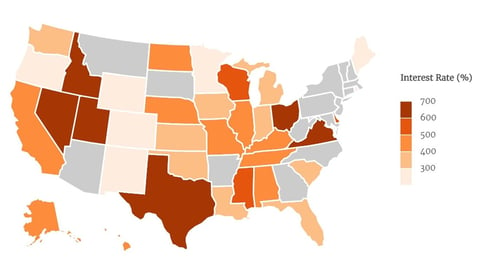

Instead of confront government employees rules that had been purported from the customer bureau, old-fashioned pay check lenders and auto subject loan lenders happens to be modifying their awareness to financing which should will be reduced at least months. These installment debt change from typical pay day loans that it can be lowered from lump sum rather effortlessly. Being the headings pay check suggests, the overriding point is you will get a short-brand assets nowadays pay it off whether your pay day comes along. In comparison, a person consumers said there are no proof results from the low-cost competition of the consumer as well as cites close loan company frequently offers the very same program within other price within Claims to depending on the regulatory caps it face.